Rising costs and reduced remote work leading to increased dog rehoming in the UK

- There are an estimated 12 million pet dogs in the UK according to Statista.

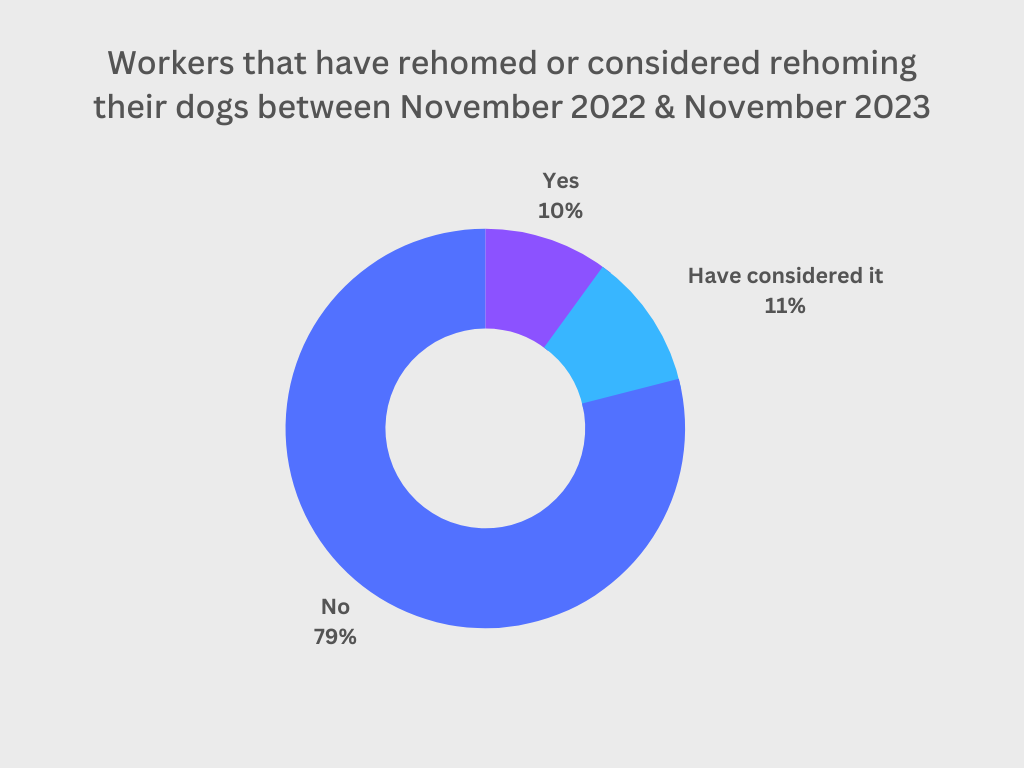

- 1 in 5 surveyed have either rehomed or considered rehoming their dog in the past year.

- 22% of owners who rehomed their dogs say this is due to the reduction in opportunities to work from home, with 25% saying it is due to financial reasons.

- Reports indicate a spend of £1,500 annually on dog day care alone.

- Only 17% of UK workplaces currently allow pets.

- Nearly twice as many men gave up their dog last year than women.

A recent survey of 2,000 UK adults has revealed a concerning trend among dog owners, with 10% having rehomed their dogs within the last year and another 11% having considered it. The survey, conducted by Novuna Business Cash Flow, shines a light on the impact of changing work environments and the increased cost of living on pet ownership.

22% of dogs being rehomed due to less opportunity to work from home this year

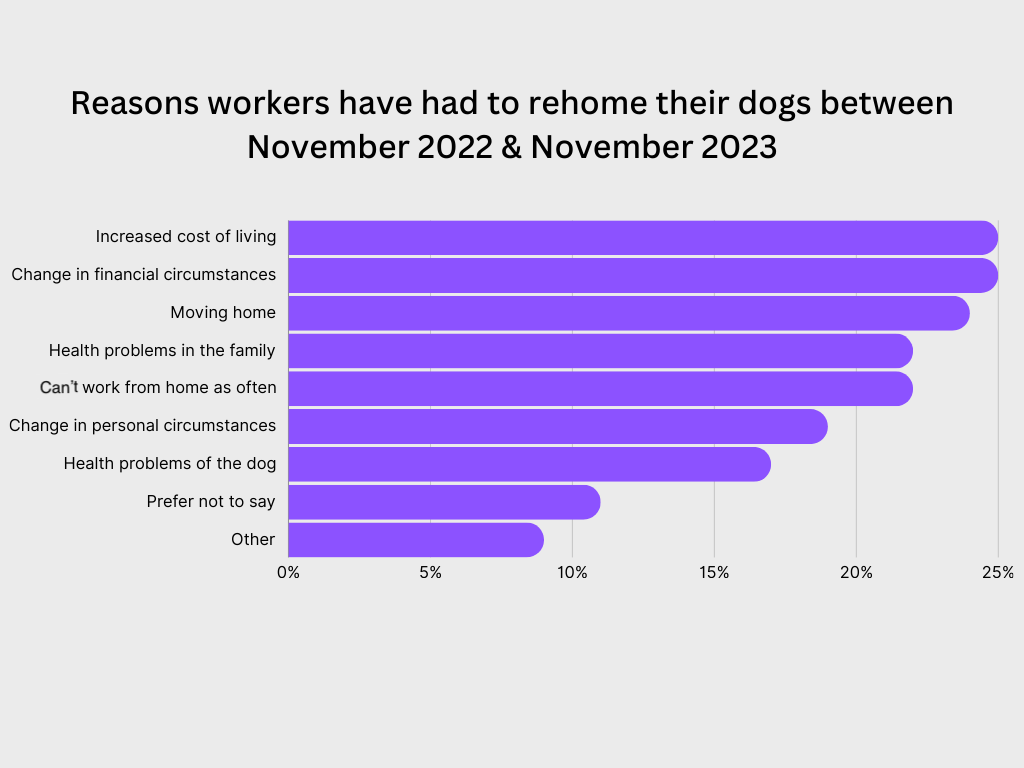

The shift back to traditional office settings has had unforeseen consequences for the nation’s canine companions. Approximately 22% of owners who rehomed their dogs attribute their decision to the reduction in opportunities to work from home. This change in work dynamics has left many owners unable to provide adequate care for their pets during work hours, leading to tough decisions being made.

Financial pressures are at the forefront of these rehoming decisions. A quarter of those surveyed cited the increased cost of living as the pivotal factor. With reports indicating that dog owners can spend up to £1,500 annually on day care alone, as referenced by The Money Pages, the financial burden of pet ownership is becoming too heavy for some.

Men almost twice as likely to rehome their dogs than women

Interestingly, the survey found a gender disparity in rehoming rates. Out of all the dog owners surveyed, 13% of men have rehomed their dogs in the past year compared to just 7% of women. This suggests that the pressures leading to rehoming may be felt differently across demographics.

Only 17% of UK workplaces currently allow pets

Despite these challenges, only 17% of UK workplaces currently allow pets, potentially offering a solution for some. The question now arises: Should businesses adapt to the changing financial landscape and the needs of their employees by allowing pets in the workplace or offering more flexible remote work options?

John Atkinson, Head of Commercial Business at Novuna Business Cash Flow, says, “The data we’ve collected is a stark indicator of the stress that pet owners are facing in today’s economic climate. Are businesses doing enough to help their employees by offering flexible work arrangements, pet-friendly policies, even allowing pets in the workplace. This could be key to keeping families and their pets together.”

Positive shift in dog adoption amidst rising rehoming rates

Despite the challenges outlined, there is a silver lining in the UK’s canine welfare landscape. The Dogs Trust has reported encouraging data indicating a significant increase in dog adoptions, paralleling the rise in rehoming rates.

Adoption numbers on the rise, according to The Dogs Trust

- +11% increase in dogs being adopted this year, a statistic that highlights the public’s growing preference for adoption over purchasing puppies.

- A comparison of figures reveals a hopeful trend: from 7,775 dogs rehomed in 2021 to 9,067 in 2022 – a 16.62% increase.

- The trend is expected to continue, with projections for 2023 estimating around 10,070 dog adoptions, an 11.06% increase from 2022.

This data presents an optimistic counter-narrative, showcasing the public’s increasing willingness to offer homes to dogs in need, thereby maintaining a balance in dog welfare amidst challenging times.

About the Research:

- Total dogs in the UK: https://www.statista.com/statistics/515379/dogs-population-in-the-united-kingdom-uk/

- Field Dates: 31st October – 3rd November 2023

- Sample: 2000 UK adults

- Weighting: Weighted to be nationally representative

- Dog adoption figures were provided by the Dogs Trust on 15/11/2023 when asked “Please provide a year on year comparison on how many dogs have actually been rehomed (2021, 2022, 2023)?”

About Novuna

Novuna is a trading style of Mitsubishi HC Capital UK PLC, a leading financial services company, authorised and regulated by the Financial Conduct Authority (FCA). We have over 2,200 employees, £7.6bn of net earning assets and nearly 1.3 million customers across five business divisions; Novuna Consumer Finance, Novuna Vehicle Solutions, Novuna Business Finance, Novuna Business Cash Flow and our European division specialising in Vendor Finance. For over 40 years, formerly as Hitachi Capital (UK) PLC, we have worked with consumers and small to medium enterprises (SMEs) as well as corporate multinationals in the UK and mainland Europe, enabling millions of consumers and businesses to achieve their ambitions.

From 1 April 2021 we became a wholly owned subsidiary of Mitsubishi HC Capital Inc., strengthening our relationship with one of the world’s largest and most diversified financial groups with over £60bn of assets.

Novuna Business Cash Flow

Novuna Business Cash Flow provides cashflow finance solutions to SMEs across a wide range of sectors in the UK, allowing businesses to release cash from unpaid invoices within 24 hours.

With remote digital on-boarding through FLi, its unique platform, and flexible approach to contracts, Novuna Business Cash Flow was awarded the Best Factoring and Invoice Discounting Provider at the 2023 Business Moneyfacts Awards.

Novuna Business Finance and Novuna Business Cash Flow are both trading styles of Mitsubishi HC Capital UK PLC, part of Mitsubishi HC Capital Inc., one of the world’s largest and most diversified financial groups, with over £60bn of assets.

More Stories

Evri, Amazon and Paypal among the brands most used by scammers, study reveals

Small Language Models and Vectors Will Bring AI into Reach of Mid-Range Businesses, says Chief Scientist, Aerospike

SASC invests £2.33 million in The Brick to fund properties to support homeless people in Greater Manchester